Tesla’s inventory worth has displayed a major diploma of volatility all through 2021. It is no surprise — it seems like all the pieces was unstable this yr. An ever-changing political ambiance, ongoing societal shifts, and a cussed pandemic have been topic to winds of change. In the meantime, the auto sector was on the mercy of a critical chip provide scarcity.

That mentioned, it seems Tesla has gotten most of its provide chain points underneath management quicker than most of its competitors. Though Tesla’s share worth has bounced round a bit this yr, in response to Brian Sozzi at Yahoo Finance, “Tesla’s inventory has a transparent shot to extra fertile grounds.”

Sozzi related with Wedbush analyst Dan Ives to get his tackle Tesla. Based on Ives, “Demand for China is the linchpin. As capability builds in Berlin and Austin [in 2022] that is what I believe sends Tesla’s inventory to $1,400 as our base case. Our bull case is $1,800.”

|

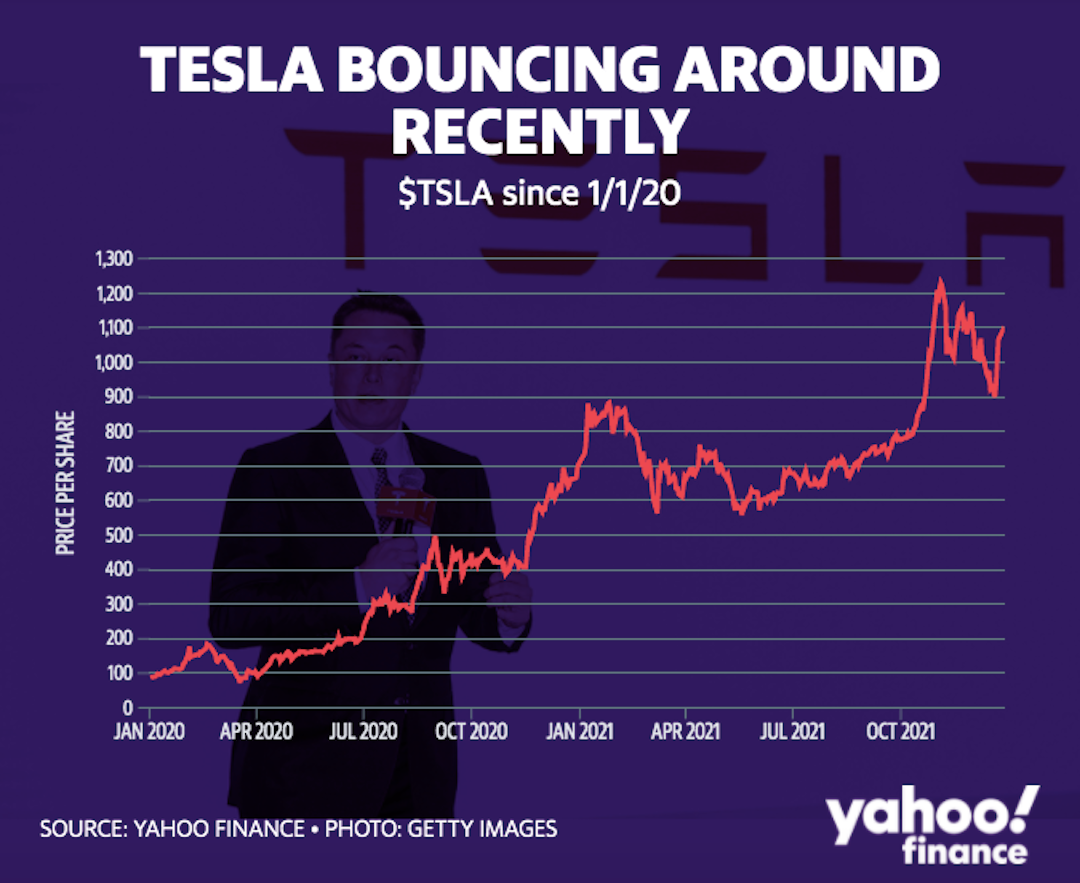

Above: A take a look at Tesla’s ongoing share worth volatility (and development trajectory) since January 1st, 2020 (Supply: Yahoo Finance)

Ives charges Tesla at Outperform and estimates 40% of Tesla’s deliveries in 2022 shall be derived from the profitable China market. As well as, Ives believes provide chain points ought to abate in 2022. And, within the quick time period, Tesla might shock the Road by delivering near 1.5 million items by year-end.

Based on Sozzi, “Tesla shares have come underneath strain in December as CEO Elon Musk sells down his stake within the firm to fulfill tax obligations. Musk has offered roughly 15.6 million shares for a shade over $16 billion, bringing him near unloading 10% of his stake within the firm as deliberate.” With Musk’s inventory sale ending, Tesla shares might rise.

Above: Wedbush Analyst Dan Ives joins Yahoo Finance’s Brian Sozzi and Julie Hyman to debate Tesla’s development outlook (YouTube: Yahoo Finance)

One other analyst, Deutsche Financial institution’s Emmanuel Rosner notes, “We proceed to see massive upside to 2022 consensus expectations… battery expertise, capability and particularly price will proceed to speed up the world’s shift to electrical autos and lengthen Tesla’s lead significantly. It must also allow Tesla to maintain increasing its working margins, seemingly exceeding 20% over the subsequent few years, representing very best-in-class efficiency.”

===

Supply: Yahoo Finance