Electrical energy has already remodeled the passenger automotive market, and large vehicles are subsequent. Tesla will formally unveil its Semi EV on December 1 and hopes to pump out as much as 50,000 electrical vehicles per 12 months as early as 2024. And it’s removed from the one firm electrifying business autos.

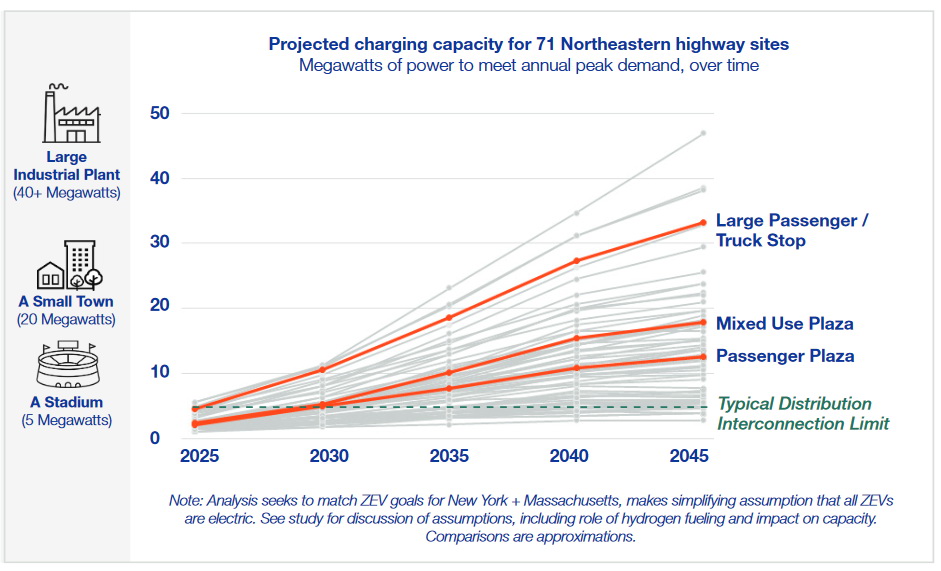

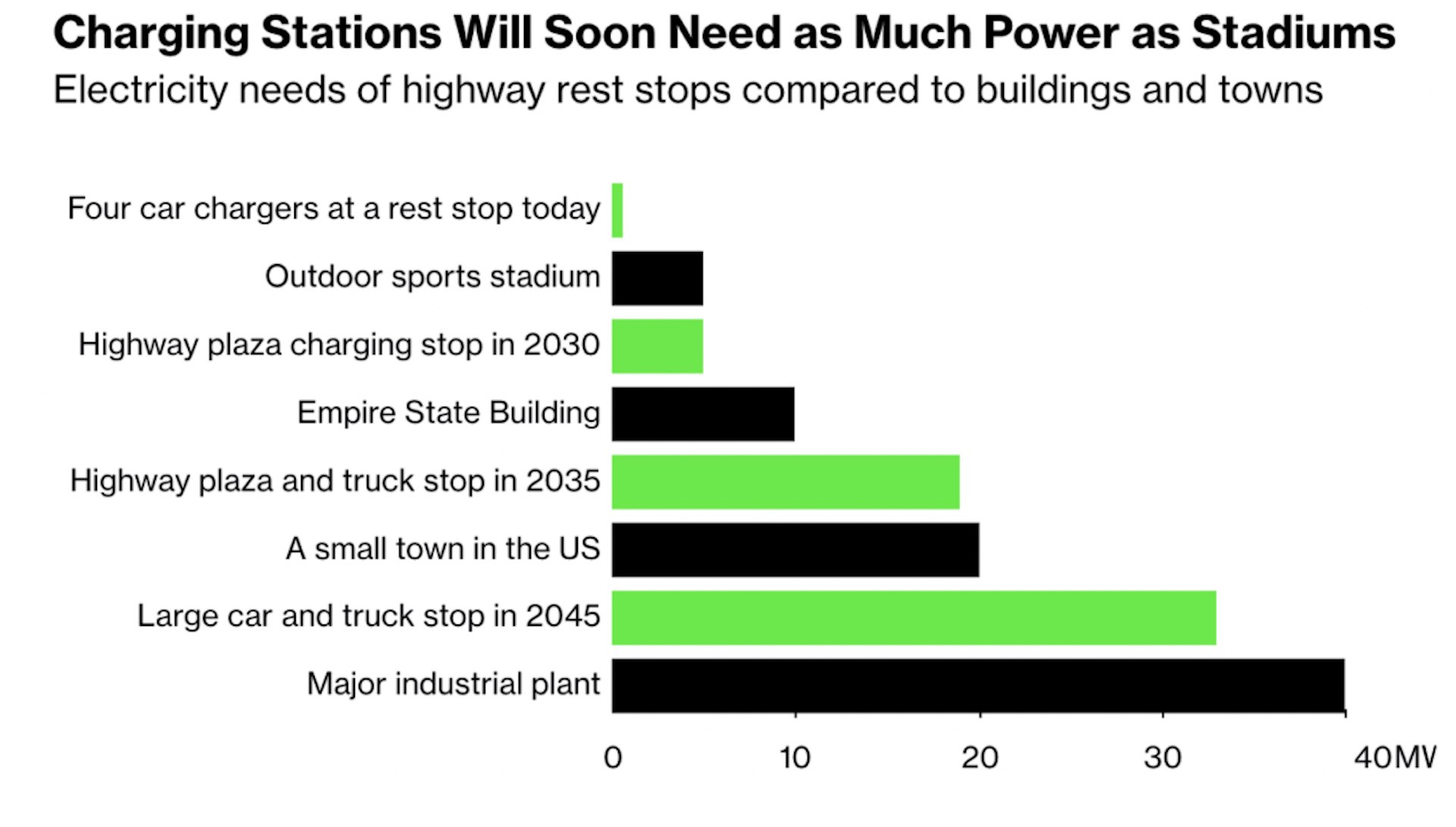

Come 2030 or 2035, shopping for an electrical truck received’t be an issue, however charging it may be, in accordance with a report by Nationwide Grid. The examine says that the electrical truck market may discover itself restricted by an insufficient charging infrastructure within the subsequent decade if main funding doesn’t occur now. Why? As a result of it estimates {that a} truck cease in 2035 would possibly want as a lot electrical energy as a small city.

It’s not the quantity of electrical energy that we’re going to wish that’s the issue, however how shortly we’re going to need to deploy it in a single place, like a truck cease filled with autos which might be successfully gargantuan 18-wheeled batteries.

Bloomberg’s sensible analogy likens electrical energy to water flowing by a hose, declaring that you may use that hose to fill a swimming pool should you had a couple of months to spare, however filling that pool in a a couple of hours is a distinct story. To do this you’re going to wish the electrical cable equal of a riot-police water canon.

So let’s get constructing, you’re considering. The issue is we should always have been constructing years in the past. A connection to the grid able to coping with greater than 5 megawatts of energy would possibly take eight years to plan and construct, and price tens of tens of millions of {dollars}. And up to date incentives from the U.S. authorities designed to advertise a swap to electrical energy has quick tracked a transfer to business EVs which may happen earlier than the charging community has been upgraded to accommodate them. That’s regardless of President Biden’s 2021 infrastructure package deal earmarking $7.5 billion to pay for a nationwide charging community and upgrades to the grid.

“We want to start out making these investments now,” Bart Franey, vp of fresh power improvement at Nationwide Grid, advised Bloomberg in an interview. “We will’t simply anticipate it to occur, as a result of the market goes to outpace the infrastructure.”

Associated: Renault Makes Enjoyable Of Tesla Semi, Says Whereas Some Make Bulletins Others Are Placing Miles On The Highway

Some fleet operators are already experiencing issues, Rakesh Aneja, head of electrical vehicles at Daimler North America, admitted. The corporate at present provides electrical vehicles within the U.S. however some prospects had been dismayed to find that it might take a 12 months longer to attach their chargers than it might to obtain their Freightliner eCascadia vehicles.

“The primary concern for fleets wanting to impress all of their autos is the infrastructure required,” Brian Wilkie, director of transport electrification at Nationwide Grid, advised Bloomberg. “They know they will’t promote vehicles with out the ability to cost. If they will resolve that piece, they will scale the market way more shortly.”