Electrical vehicles will not be exempt from automobile excise obligation from April 2025, the chancellor has stated.

Saying the change as a part of his Autumn Assertion, Jeremy Hunt stated the transfer was designed to make the motoring tax system “fairer”.

The RAC motoring group stated it didn’t count on the change to dampen demand for electrical autos (EVs).

However others, together with the AA, warned the transfer would cut back the motivation to change to EVs.

Mr Hunt stated: “As a result of the OBR (Workplace for Funds Accountability) forecasts half of all new autos can be electrical by 2025, to make our motoring tax system fairer I’ve determined that from then, electrical autos will not be exempt from automobile excise obligation.”

Car Excise Obligation (VED) is a tax levied on autos on UK roads. At current, EVs are exempt.

There are totally different charges relying on the automobile.

Beneath the plans laid out at present, electrical vehicles registered from April 2025 pays the bottom fee of £10 within the first yr, then transfer to the usual fee which is at the moment £165.

The usual fee can even apply to electrical autos first registered after April 2017.

The chancellor stated firm automotive tax charges for electrical autos will stay decrease than for historically fuelled autos.

RAC head of coverage Nicholas Lyes stated: “After a few years of paying no automotive tax in any respect, it is in all probability honest the federal government will get homeowners of electrical autos to begin contributing to the maintenance of main roads from 2025.

“Car excise obligation charges are unlikely to be a defining purpose for automobile selection, so we do not count on this tax change to have a lot of an impact on dampening the demand for electrical autos given the numerous different value advantages of working one.”

The Native Authorities Affiliation additionally welcomed the transfer, saying that though electrical vehicles are a lot much less dangerous for the setting than petrol and diesel vehicles, they nonetheless contribute to carbon emissions, congestion, and put on and tear on roads.

“It is solely honest then that drivers contribute in direction of these extra prices and assist help funding in even decrease carbon alternate options comparable to public transport, buses, biking and strolling,” stated its transport spokesperson, David Renard.

Nevertheless, the AA stated the introduction of the tax on electrical vehicles would “gradual the highway to electrification”.

“This will likely delay the environmental advantages and stall the introduction of EVs onto the second-hand automotive market. Sadly the chancellor’s EV taxation actions will dim the motivation to change to electrical autos,” stated Edmund King, AA president.

Nissan, which makes the Leaf electrical automobile, additionally stated it was involved concerning the influence available on the market, however stated it could proceed to work with the federal government “to sort out the principle obstacles to the electrical automobile transition, together with public charging and measures to proceed to help the acquisition of EVs”.

Kia, which sells hybrid and absolutely electrical vehicles, stated introducing the tax on EVs was “at odds with the nation’s net-zero ambitions”.

In one other change unveiled within the Autumn Assertion, the exemption for electrical vehicles from the costly automotive complement has additionally been eliminated.

It means anybody shopping for a brand new automotive – electrical or in any other case – priced at greater than £40,000 will face having to pay £165 in tax plus a £355 costly automotive complement yearly from the second to sixth yr of registration.

Mike Hawes, chief government of the Society of Motor Producers and Merchants, stated the change to the costly automotive complement was “the sting within the tail” of the announcement, including it “will unduly penalise these new, costlier automobile applied sciences”.

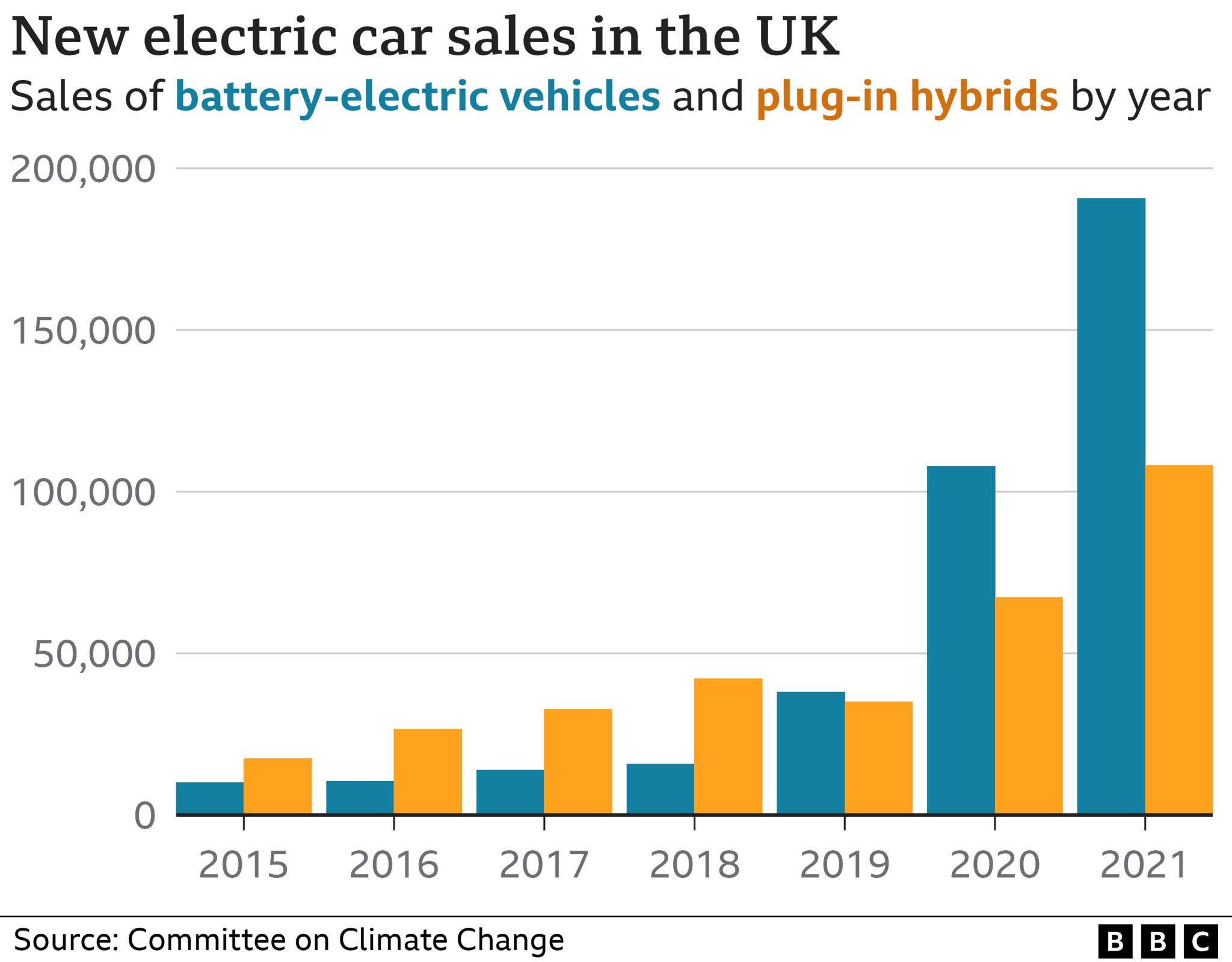

The sale of latest petrol and diesel vehicles is because of be banned within the UK from 2030.

This has prompted the query of how the tax income raised from automotive tax (VED) and gasoline obligation could be changed. Between them, they increase some £35bn a yr.

In February, a committee of MPs recommended the federal government contemplate a type of “highway pricing”, the place drivers pay in keeping with the gap they’ve pushed, the kind of automobile, and congestion.

This has been recommended prior to now however proved unpopular. Nevertheless, the RAC thinks drivers now help the precept of “the extra you drive, the extra tax you must pay”.

As we speak, the chancellor didn’t decide to that.

However his announcement implies that in only a few years’ time, electrical automotive homeowners will go from paying no automotive tax, to paying the identical as homeowners of petrol or diesel vehicles.

Plus, homeowners of costlier fashions will face the additional value of an annual complement for 5 years.

Ian Plummer, director of automotive firm Auto Dealer, stated the transfer would “drive extra would-be consumers away from EVs” at a time when different incentives are additionally being eliminated, and excessive power payments are decreasing the deserves of going electrical.

In the meantime there was no point out in Thursday’s Assertion about what is going to occur to gasoline obligation subsequent yr. This makes up a considerable quantity of the worth paid for petrol and diesel on forecourts.

It’s scheduled to rise annually, however has been frozen since 2011. On the Spring Assertion in March, it was reduce by 5p to 53p, for 12 months.

As we speak the OBR stated it expects a 12p rise in gasoline obligation from April – if that 5p reduce does finish and there is not one other freeze.

Nevertheless, the Treasury stated a closing resolution on gasoline obligation could be made on the Spring Funds.

Extra on the Autumn Assertion

- LIVE REACTION: Comply with the newest on our reside web page

- EXPLAINED: What’s going to it imply for my cash?

- ENERGY: What’s occurring to my payments?