Tesla is now providing a $5,000 CAD/$74,750 MXN credit score on Mannequin 3 and Mannequin Y automobiles bought in Canada and Mexico earlier than the tip of this yr. It’s a uncommon occasion of Tesla providing reductions, and could possibly be an indication of softening demand in North America.

The transfer comes simply after Tesla elevated the year-end low cost to $7,500 within the neighboring US.

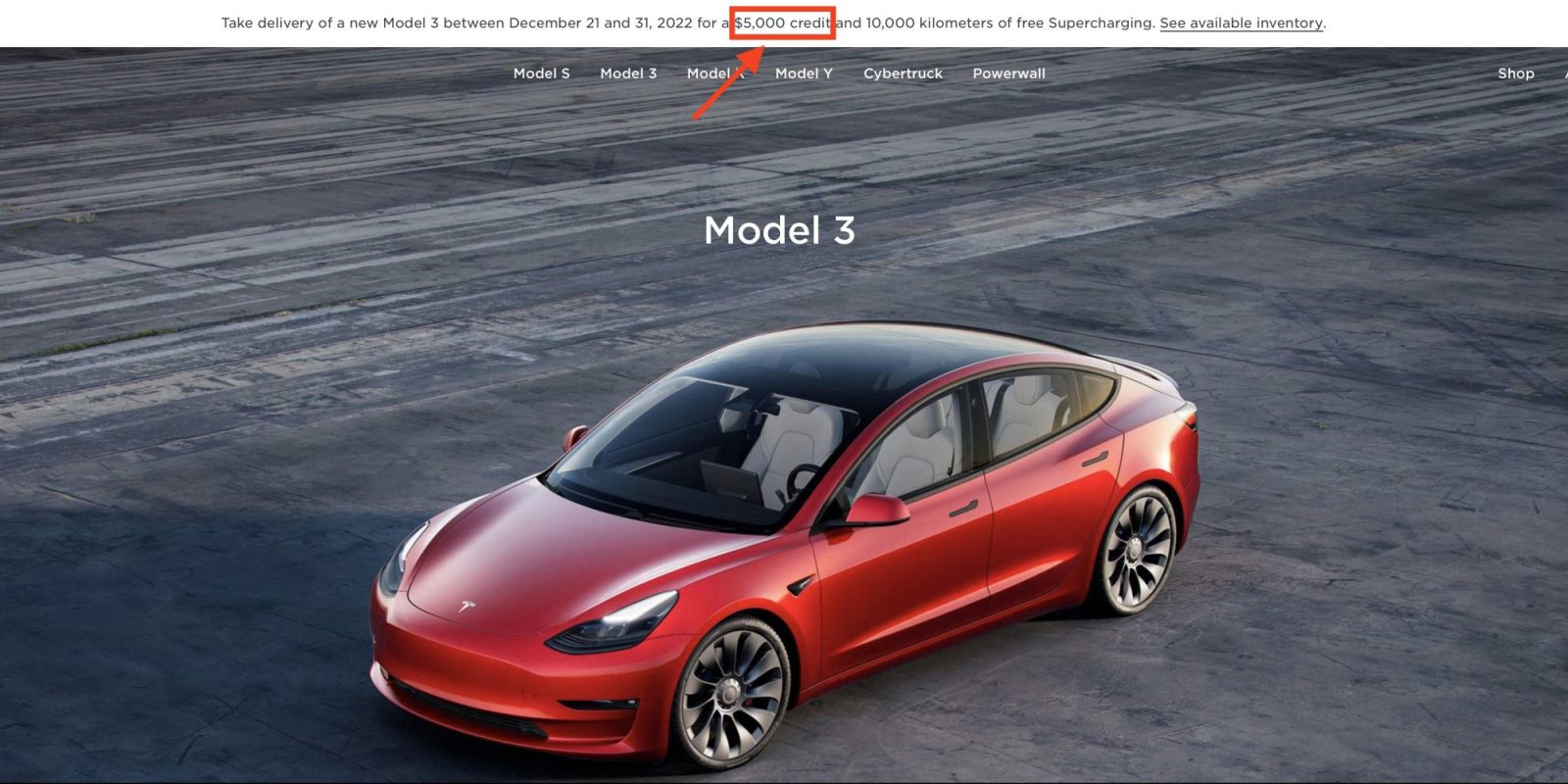

Tesla refers back to the low cost as a “credit score” on their web site, although the accompanying “Be taught Extra” hyperlink merely describes the specifics of the lately introduced supercharger credit score, out there since December 15, and omits any specifics concerning the credit score:

Tesla is providing free Supercharging credit* — as much as 10,000 kilometers of driving—for purchasers who take supply of a brand new Tesla car between December 15 and December 31, 2022. Free Supercharging might be credited to your Tesla Account within the month of January 2023 and can stay legitimate for a interval of two years out of your supply date.

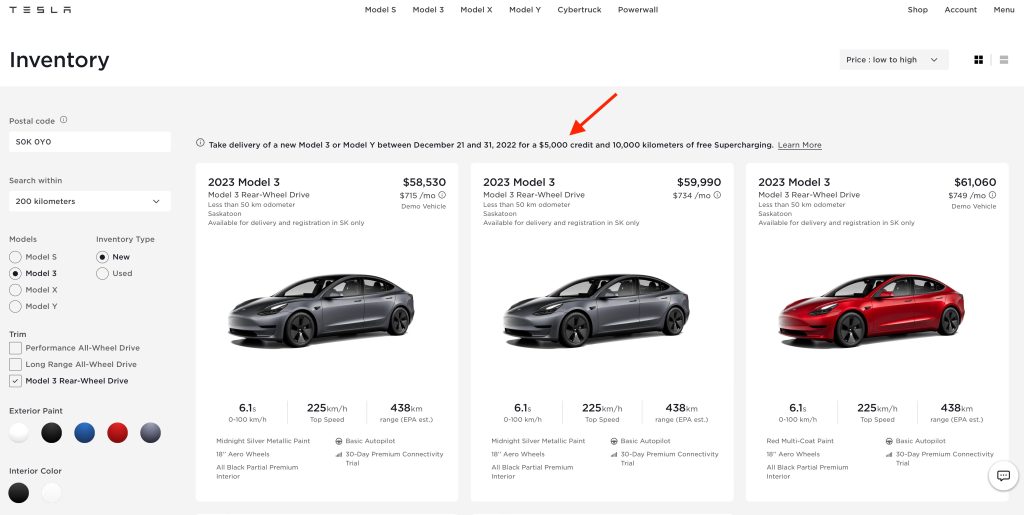

However stock automotive costs don’t present this credit score as being utilized already, as seen within the screenshot beneath:

The center automotive, at $59,990 CAD, reveals the identical value as a custom-order configured automotive with the identical base mannequin specs. So stock automobiles can count on a further $5,000 CAD low cost past the listed pricing on the web site, however we don’t know precisely how that “credit score” might be utilized. You’ll need to ask your Tesla salesperson for the specifics.

The Canadian and Mexican reductions are nearly an identical to Wednesday’s further US low cost. Each convert to roughly $3,750 USD, which is the quantity Tesla raised the US low cost by.

Within the US, this low cost was largely regarded as a response to altering EV tax incentives. It had beforehand been anticipated that Teslas would qualify for $3,750 in EV tax credit subsequent yr because of the Inflation Discount Act, however the Treasury introduced Monday that they’re delaying new guidelines, which suggests Teslas will now qualify for $7,500 in tax credit not less than till a while in March. Consequently, patrons may delay buy for a couple of weeks to get new tax credit, so if Tesla needs to promote automobiles now, it is sensible to supply a brief low cost.

However Canada and Mexico do not need the same tax credit score change coming at first of the yr, so the low cost in these territories should not be related to that. Which implies this could possibly be a sign that Tesla sees a less-crowded order e-book than traditional on this vacation season, and must spur curiosity by dangling a uncommon carrot in entrance of patrons.

Tesla usually has end-of-quarter and end-of-year pushes for deliveries, shifting worker focus to delivering automobiles for the previous couple of weeks of 1 / 4 so as to end out robust with excessive numbers. The corporate has said for years that they wish to cease doing end-of-quarter supply pushes, however that effort by no means actually materialized and the corporate continues the follow mainly each quarter.

These pushes often materialize within the type of an all-hands motivational e-mail (with gratuitous use of the phrase “hardcore”) from CEO Musk, however he’s a little bit distracted from Tesla for the time being. Tesla additionally sometimes presents perks like free supercharging to get prospects within the door on the finish of the yr. However now, we’re seeing a uncommon occasion of Tesla providing reductions on their automobiles to inspire patrons to come back in.

Tesla automobiles have obtained a number of value will increase over the past yr, possible resulting from elevated provide chain prices and customarily hovering EV demand general. With EV provide being decrease than demand, costs of many EVs have gone up.

However the auto market is lastly beginning to stabilize in the previous couple of months, with new and used automotive costs beginning to flatten out from their earlier upward development.

So this new low cost doesn’t make up for this yr’s value will increase, however not less than it’s a reversal of the current trajectory of Tesla costs. That mentioned, it is just non permanent – or perhaps it’s an indication that Tesla’s value will increase have gotten a little bit overzealous and the corporate could must appropriate in the wrong way on account of softening demand in North America.

Electrek’s Take

As Fred talked about in his Take for Tesla’s authentic $3,750 US low cost, Tesla has by no means actually had bother with demand, and has by no means wanted to supply reductions in consequence. He talked about that his signal for waning Tesla demand could be when Tesla begins providing reductions.

The US reductions look like a response to tax credit score adjustments, and could possibly be defined away thusly.

However this low cost can’t be defined away as a response to altering authorities incentives. It doesn’t apply to Europe or Asia, solely to North American automobiles, which by the way are all produced in the identical North American factories. It appears possible that Tesla could have an excessive amount of NA stock and desires to get a few of it off their arms, and become money, earlier than it reveals up on stability sheets on the finish of the fiscal yr.

Or perhaps Tesla wished to align pricing throughout territories – but when so, then why no low cost in Europe, and why solely $3,750 USD (equal) and never $7,500?

The transfer additionally comes amid falling recognition for the model resulting from CEO Elon Musk’s current shenanigans.

This could possibly be an indication that Tesla demand, which has persistently risen at unimaginable charges for therefore a few years, may not less than be rising much less rapidly than it beforehand has.