The traditional Corvette is lacking an engine, a transmission, an inside, and is now in some way valued at $12,000

9 hours in the past

by Stephen Rivers

Used automotive costs have been sky-high for a couple of years now and traditional vehicles have seen an analogous bump. For one man in Kansas, that bump now has him paying some 1,177 p.c extra in property taxes on a non-running Corvette components automotive in his storage. Now, he’s set as much as battle the state over a $718 property tax invoice.

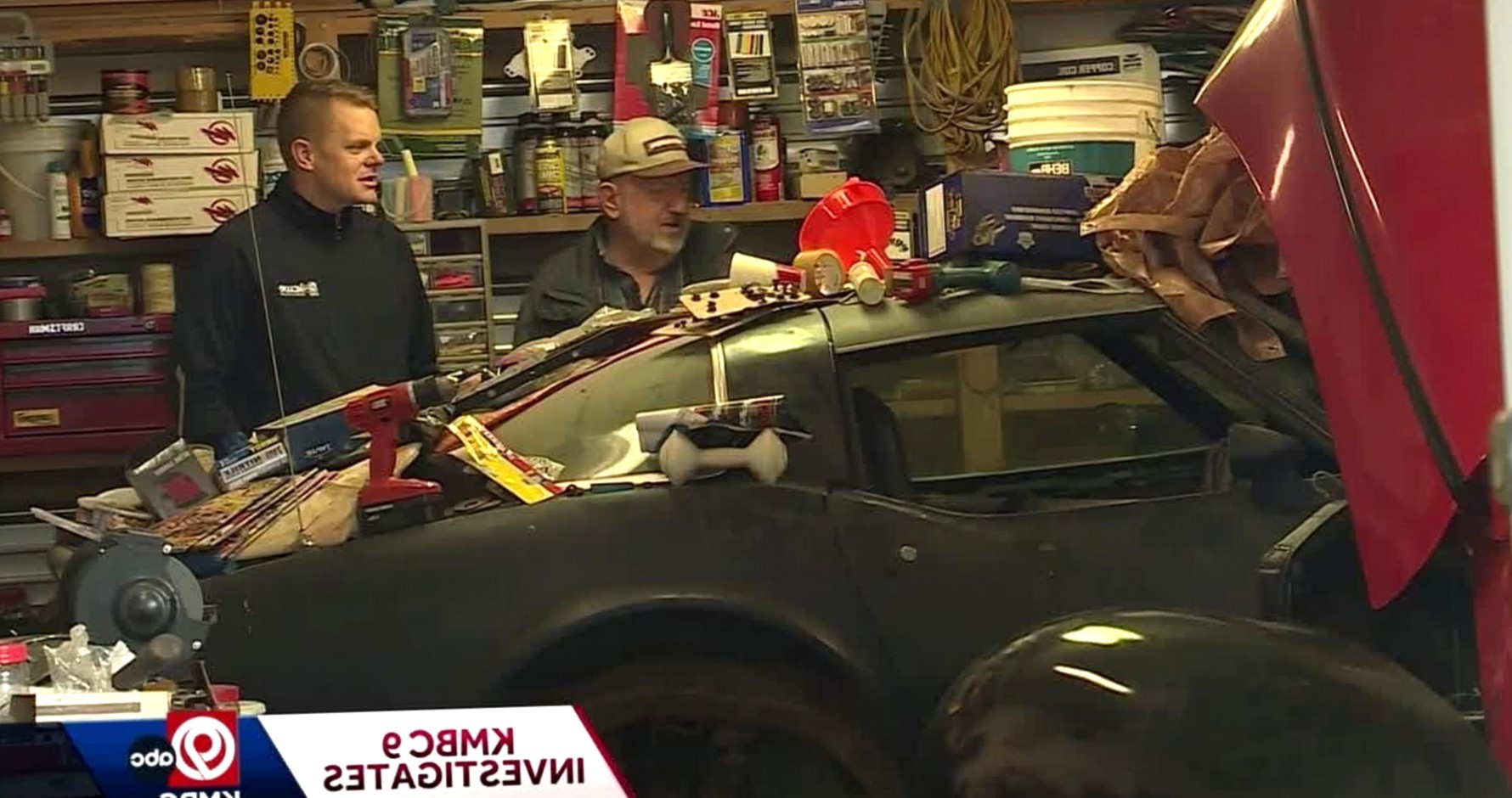

That man is Don Hawley of Douglas County, Kansas. His components automotive is a 1979 Chevrolet Corvette and to place it flippantly, it’s seen higher days. Because it sits it has no engine, no transmission, principally no inside, and is kind of clearly an precise shell of its former self. That’s why Hawley was so shocked when the county assessed the car with a $12,000 worth.

To place that into perspective, Hawley paid $1,000 for the automotive again in 2015 and till this 12 months, had by no means needed to pay greater than $61 in taxes yearly for it. Understandably then, he seems like this new leap within the charge is “fairly unrealistic for a automotive body.”

Extra: This Poor Ferrari 488 Spider Is One other Sufferer Of Florida’s Hurricane Ian

In accordance with the state, the valuation is predicated on the Nationwide Automotive Sellers Affiliation (NADA) information. Previous to this 12 months, it had primarily based the worth on the acquisition worth of the car “attributable to the truth that workers weren’t in a position to find a price within the NADA guides.”

Evidently, the state has offered Mr. Hawley with the required directions surrounding a protest of the charge. He’ll nonetheless want to leap by means of a little bit of pink tape simply to have the prospect for it to be diminished although. Not solely does he need to file the protest however he’ll additionally want to offer extra documentation as to the situation of the Corvette.

commercial scroll to proceed

He’s mentioned that he’ll observe by means of with the protest however a decision has but to return. For now, the ethical of the story appears to be to maintain an in depth eye on one’s personal private property taxes and be able to struggle ought to one thing related occur.