Japan’s largest automaker, Toyota Motor, is shedding employees in China as the corporate struggles to maintain up on this planet’s largest EV market.

Toyota lays off employees amid China’s EV transition

Japanese automakers are stumbling in China’s evolving auto panorama. In response to a brand new report from Reuters, Toyota’s three way partnership with China’s Guangzhou Car Group (GAC) laid off employees this weekend, providing them compensation.

Three employees who have been affected stated the transfer comes because the Japanese automaker is struggling in China’s ultra-competitive auto market that’s quickly transitioning to EVs.

The three way partnership’s manufacturing facility in China employs round 19,000 individuals, producing fashions resembling Toyota’s first EV, the bZ4X, alongside the Camry and Levin fashions.

Toyota launched the bZ4X in China in October 2022 with a beginning worth of 199,800 yuan (round $19,000). Nevertheless, after a number of market leaders, together with BYD and Tesla, reduce costs, Toyota failed to achieve traction.

The Japanese automaker offered 3,844 bZ4X fashions in China via January, representing simply 0.26% of China’s EV market.

To spice up gross sales and stay aggressive, the automaker slashed costs by 15% in response earlier in February, with a brand new beginning worth of round 169,800 yuan ($24,800).

To this point, the transfer has didn’t make a distinction, with EV gross sales falling 9% within the first six months of the yr.

Regardless of launching its first electrical sedan in China earlier this yr, the BYD-powered bZ3 beginning at 189,800 yuan ($27,000), Toyota (via FAW-Toyota) is recalling (not OTA) over 12.2K bZ3 electrical sedans over faulty rear door handles.

After taking up for longtime chief and grandson to the corporate’s founder (Akio Toyoda) in April, former Lexus branding chief officer Koji Sato stated Toyota would want to behave urgently to maintain up in China’s EV market.

After seeing the impression of EVs on the Shanghai Auto Present, Sato defined:

We have to improve our pace and efforts to firmly meet the client expectations within the Chinese language market.

In the meantime, Toyota will not be the one Japanese automaker struggling in China amid the nation’s shift to EVs.

China’s EV market takes a toll on Japanese automakers

In response to the China Affiliation of Car Affiliation, Japanese automakers’ market share within the area has fallen from 20% final yr to 14.9% within the first half of 2023.

Electrical car gross sales in China reached over 2 million via the primary 5 months of the yr, up 51.5% YOY as consumers proceed adopting EVs at a file tempo.

Japanese automakers, who’ve been arguably the most important laggards within the EV market, are feeling the pinch essentially the most.

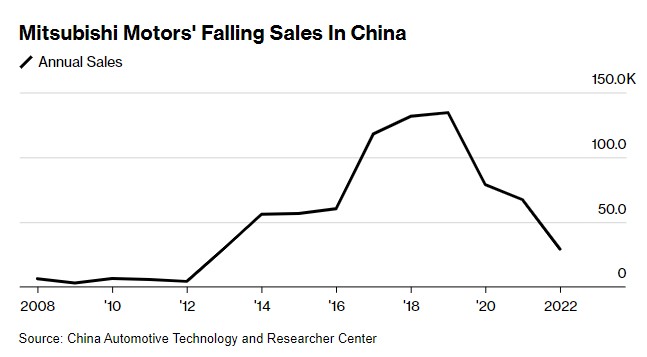

For instance, Mitsubishi Motors revealed in a memo final week it was suspending operations in China indefinitely after gross sales fell drastically. The memo (through Bloomberg) acknowledged:

Previously few months, administration and shareholders have tried to the perfect of our skill, however resulting from market situations and with nice reluctance and remorse, we should seize the chance to transition to new vitality autos. The corporate will resurrect after going via trials and tribulations.

After peaking at over 134K in 2019, Mitsubishi’s gross sales have fallen considerably, with solely 34.5K autos offered in 2022. The decline in gross sales correlates with China’s booming EV market, fueled by clear vitality incentives and different authorities initiatives.

Almost all Japanese automakers, together with Honda, Mazda, and Nissan, are seeing gross sales fall in China resulting from an absence of electrical car fashions to compete with home automakers.

Gross sales of Chinese language manufacturers accounted for 53% of the market via the primary half of the yr as home EV makers like BYD, NIO, Li Auto, and XPeng proceed to seize market share with distinctive fashions in basically each section.

Electrek’s Take

Though Electrek has been saying it for years, Japan’s reluctance to supply electrical autos is already beginning to value them.

China is the world’s main EV market because the trade continues to undertake electrical automobiles at a file tempo.

Final yr, a Local weather Group report warned Japan may danger a 14% drop in GDP if it failed to spice up EV output, and it continues to look increasingly obvious that’s the course we’re headed.

Japanese automakers usually are not the one ones feeling the warmth. Volkswagen, which has been a pacesetter in China, noticed gross sales drop 3.6% final yr and was surpassed by BYD in passenger automobile gross sales for the primary half of the yr.

In gentle of this, most automakers talked about right here have not too long ago ramped up EV efforts, together with investing in battery tech, devoted EV platforms, and extra environment friendly fashions.

Japan is rising help to advance storage battery tech with over 330 billion yen ($2.3B) in subsidies. Toyota is about to obtain almost 120 billion yen ($847M) of it to gasoline its not too long ago revealed EV battery plans.