DETROIT – Basic Motors secured a brand new $6 billion line of credit score because the automaker braces for extra strikes by the United Auto Employees union.

“The ability that we introduced immediately is a $6 billion line of credit score that I feel is prudent in mild of among the messages that we have seen from among the UAW management that they intend to pull this on for months,” CFO Paul Jacobson instructed CNBC’s Phil LeBeau in an interview on “Halftime Report.”

The focused strikes already price the automaker $200 million throughout the third quarter, GM stated Wednesday.

A GM spokesman stated the $200 million strike price is because of misplaced manufacturing on wholesale quantity, largely as a result of UAW’s preliminary Sept. 15 strike at GM’s midsize truck and full-size van plant in Wentzville, Missouri. The strike has since expanded to GM’s components and distribution amenities nationwide and, as of final Friday, a crossover plant in mid-Michigan.

Because of the strike in Missouri, GM additionally idled its Fairfax Meeting Plant in Kansas, the place it builds the Cadillac XT4 SUV and the Chevrolet Malibu sedan, and laid off practically 2,000 employees.

Each GM CEO Mary Barra in addition to Ford Motor CEO Jim Farley have publicly criticized UAW President Shawn Fain and the union’s strike technique, claiming Fain shouldn’t be truly excited about reaching offers for 146,000 employees with GM, Ford and Chrysler guardian Stellantis.

“It is clear that there is no such thing as a actual intent to get to an settlement,” Barra stated in an emailed assertion Friday evening. “It’s clear Shawn Fain desires to make historical past for himself, however it may well’t be to the detriment of our represented staff members and the trade.”

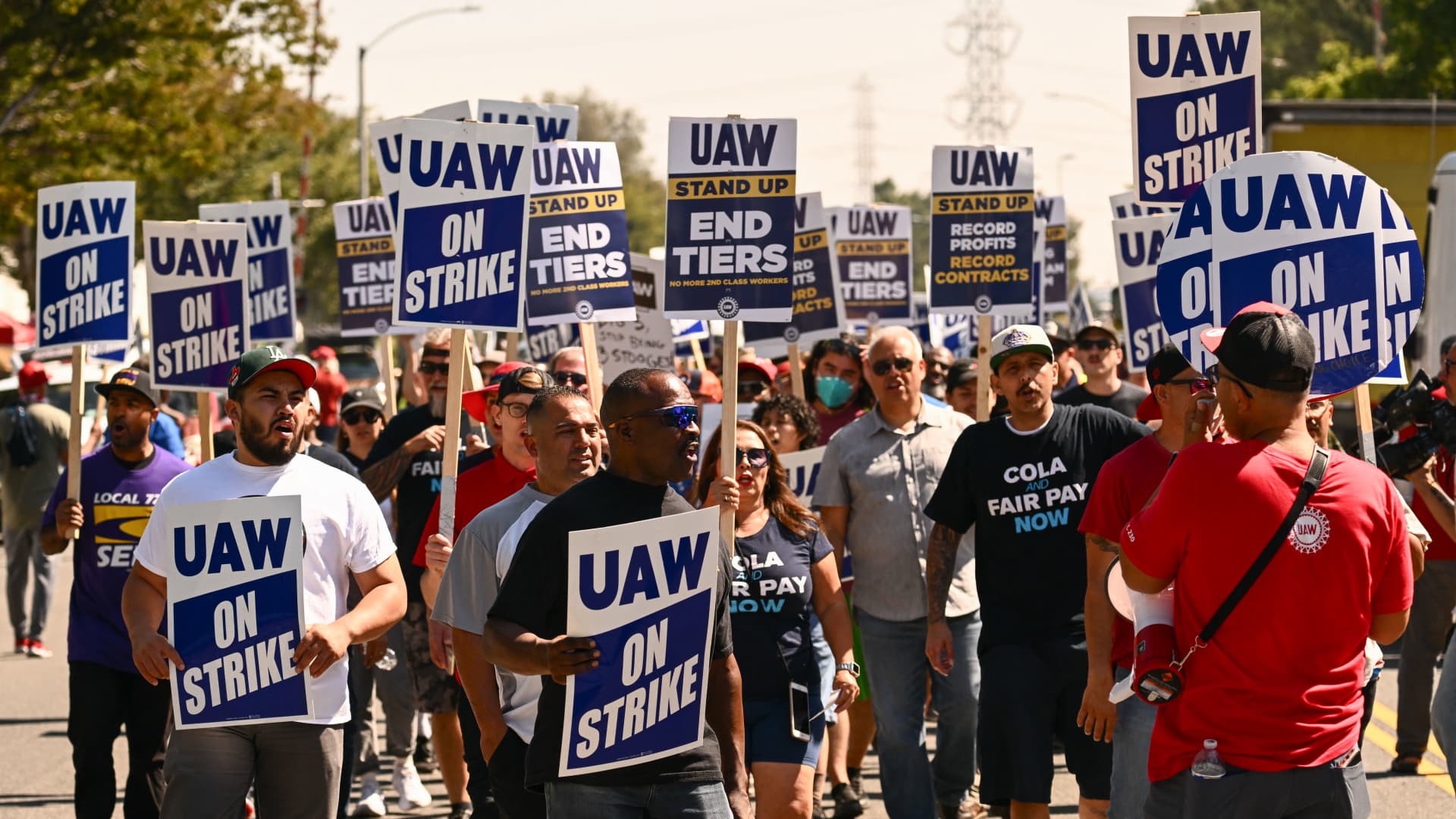

Fain has persistently stated the union is out there to barter 24/7 and has in flip accused the automakers of slow-walking negotiations.

GM’s newly introduced line of credit score would require the automaker to keep up at the least $4 billion in international liquidity and $2 billion in U.S. liquidity. The phrases of the credit score settlement additionally prohibit GM from mergers or gross sales of property and limits on different, new debt. As of June 30, GM’s complete automotive liquidity was $38.9 billion.

The credit score line comes greater than a month after Ford obtained a $4 billion line of credit score to assist it handle by way of “uncertainties” available in the market.