The US Treasury Division launched up to date steerage right this moment on EV charger tax credit score eligibility for people and companies – right here’s the lowdown.

The 30C EV charging tax credit score

When the Inflation Discount Act turned regulation in August 2022, it offered a tax credit score for as much as 30% of the price of certified EV charging “property.” Formally referred to as the Different Gas Car Refueling Property Credit score, the IRA modified the limitation on the 30C EV charging tax credit score in order that it not applies on a per-site foundation and as an alternative now applies per single merchandise of EV charging property – that’s, per charger.

The US Treasury’s EV charger tax credit score (which is claimed on IRS Kind 8911) is proscribed to $1,000 for people claiming for house EV charging and $100,000 – up from $30,000 – for enterprise properties. That got here into impact on January 1, 2023 (i.e., a 12 months in the past).

The tax credit score may also be claimed by direct pay, so “eligible entities reminiscent of governments and tax-exempt organizations making investments in EV infrastructure can profit.”

Location, location, location

The IRS’s newest steerage is about how as a way to qualify for the 30C EV charging tax credit score, people and companies must be in an “eligible census tract.” The IRS defines an eligible census tract as “any inhabitants census tract that qualifies as a low-income group or that isn’t an city space.”

The White Home stated right this moment that eligible census tracts will “affirm that the Inflation Discount Act’s 30C EV charging tax credit score is accessible to roughly two-thirds of Individuals.”

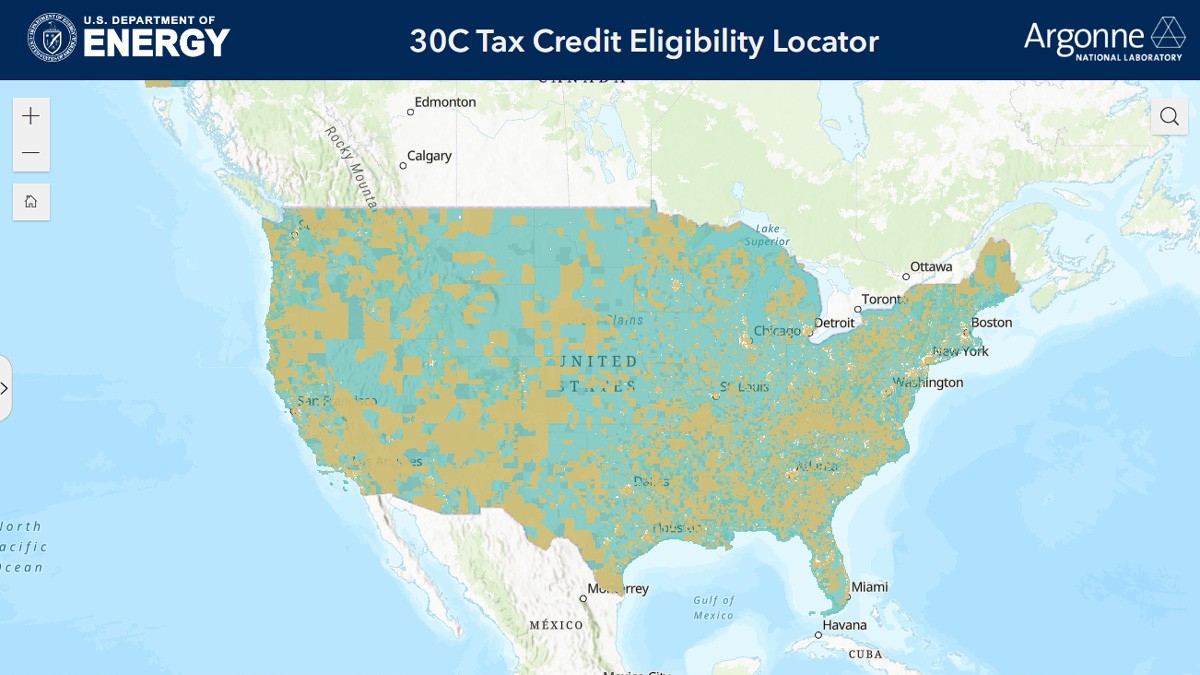

The US Division of Power and Argonne Nationwide Laboratory have now launched a mapping instrument to assist people and companies discover out whether or not they’re eligible for the 30C EV charging tax credit score. (Word that there’s a disclaimer on the map that claims it’s not formal IRS steerage – and neither is this text! – so when the time involves file your taxes, seek the advice of with a tax skilled to verify eligibility.)

The Zero Emission Transportation Affiliation’s (ZETA) government director, Albert Gore III, stated, “Because the principal incentive for charging infrastructure, 30C performs an outsized function in transitioning our nation to electrical automobiles.

“We … now have 170,000 publicly out there EV chargers throughout the nation. The Biden Administration set a aim of deploying 500,000 public chargers by 2030. To comprehend this formidable aim, the 30C tax credit score should be carried out successfully.”

You will discover the 30C Tax Credit score Eligibility Locator map right here.

Argonne additionally has a useful FAQ concerning the 30C tax credit score right here.

Learn extra: Right here’s how a lot cash you’ll get with the Inflation Discount Act

If you happen to’re an electrical car proprietor, cost up your automotive at house with rooftop photo voltaic panels. To ensure you discover a trusted, dependable photo voltaic installer close to you that provides aggressive pricing on photo voltaic, try EnergySage, a free service that makes it straightforward so that you can go photo voltaic. They’ve tons of of pre-vetted photo voltaic installers competing for what you are promoting, making certain you get prime quality options and save 20-30% in comparison with going it alone. Plus, it’s free to make use of and also you gained’t get gross sales calls till you choose an installer and share your cellphone quantity with them.

Your customized photo voltaic quotes are straightforward to check on-line and also you’ll get entry to unbiased Power Advisers that will help you each step of the best way. Get began right here. –advert*